Why Insurance Adjusters Prefer Working With Well Documented Restoration Companies

Most restoration companies believe adjusters push back on claims because they want to reduce payouts. In reality, most adjusters want clarity. They want proof of damage, consistent moisture logs, clear job notes, and organized photos that show what happened and why the chosen mitigation steps were necessary. Insurance adjusters' restoration documentation reviews become easier when the claim file feels complete. When the file is clear, adjusters approve more work, trust the company, and process payments faster.

The biggest reason adjusters prefer well-documented companies is simple. Good documentation reduces uncertainty. When moisture readings are captured at the start, when photos show affected areas, and when notes explain the timeline, adjusters do not have to guess. They can verify the loss quickly. Poor documentation forces them to search for missing pieces, which slows down approvals and increases the likelihood of reductions. A well-documented file makes everyone’s job easier.

Another reason adjusters appreciate strong documentation is that it protects them internally. Adjusters are held accountable for the files they approve. If a manager or auditor reviews a case and sees gaps, the adjuster faces questions. When a restoration company provides complete logs, clear narratives, and consistent evidence, the adjuster has support for every decision. Insurance adjusters' restoration documentation reviews go more smoothly when the file reduces risk for the adjuster.

Clear communication is part of documentation. Adjusters prefer companies that send updates without being asked, answer questions quickly, and provide progress information as the job moves forward. When a restoration company communicates early and consistently, the adjuster can keep the file moving. Slow or inconsistent communication forces the adjuster to chase down information, which increases friction. Strong communication builds trust fast.

Organized photo documentation is another key advantage. Adjusters rely heavily on photos to validate the scope. Many restoration companies upload hundreds of images with no structure. This makes it difficult for adjusters to understand the sequence of events. A company that organizes photos by room, angle, and timeline creates a clear story. Insurance adjusters' restoration documentation reviews become smoother when visual evidence matches written notes.

Daily moisture logs influence approvals more than most owners realize. Adjusters expect consistent readings that show progress. If logs are missing or incomplete, they question how long the equipment was needed. This often leads to reduced charges. Companies with strong daily logs receive fewer reductions. They also build long-term trust because adjusters know they can rely on accurate data.

Narrative notes add context. Adjusters want to understand the source of loss, the materials affected, and the justification for mitigation steps. When a restoration company provides short, clear descriptions, the adjuster can approve the claim with confidence. When notes are missing or vague, the adjuster delays the file. Good narratives increase approval rates because they eliminate guesswork.

Another factor is job completeness. Adjusters dislike receiving files that feel open-ended. When documentation shows clear start and finish points, final readings, and complete cleanup, adjusters process payments faster. A complete file signals that the restoration company is thorough. Adjusters naturally prefer working with companies that make their workload lighter.

Professionalism also matters. Restoration companies that label documents properly, upload files in a structured format, and maintain consistent organization stand out. Adjusters quickly learn which companies produce clean files and which ones create chaos. Insurance adjusters' restoration documentation preferences always favor companies that organize well because it saves them time.

Fast response to supplement requests is another trust builder. Sometimes adjusters need clarification or additional photos. When a company responds within minutes or hours instead of days, it strengthens the relationship. Adjusters remember who makes their job easier. Over time, they prefer working with companies that consistently deliver strong documentation.

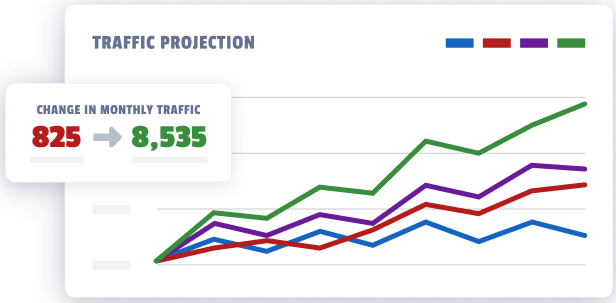

Restoration Growth Partners helps companies build documentation systems that improve insurance approvals. We train teams on photo standards, moisture mapping, narrative notes, file organization, and communication habits. These improvements shorten payment cycles, reduce invoice reductions, and increase average job value. When your documentation supports the adjuster instead of confusing them, you get paid more and faster.

Insurance adjusters' restoration documentation expectations are not complicated. They want clarity, consistency, and proof. When a restoration company delivers all three, claims move smoothly, relationships strengthen, and revenue grows predictably. This is one of the highest leverage improvements a restoration business can make.